real estate tax shelter example

Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges. Reform of Real Estate Tax Shelters 7 U.

Exploring The Estate Tax Part 2 Journal Of Accountancy

A tax shelter is among other things any investment that has a tax shelter ratio exceeding 2 to 1.

:max_bytes(150000):strip_icc()/Tax-Free-Municipal-Bond-Investing-57a525da3df78cf459871531.jpeg)

. As part of real estate tax shelters depreciation operating expenses long-term capital gains and 1031 exchanges can be applied. Ritter Sunley Real Estate and Tax Reform. In this article well take a look at how investors can calculate a baseline tax shelter on their real property assets.

Now 50 will be kept aside per day as an investment in any of the tax shelters. The tax shelter ratio is the aggregate amount of deductions to the amount invested. How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector.

You should always consult with a professional but for a general overview check out A Beginners Guide Real Estate Tax Deductions Commercial vs. Real Estate. One such loophole for example is the de minimis safe harbor which says that if you spend 500 or less on some item you can just deduct the item.

For example if you buy ten 500 appliances for your apartment house you can simply write off in the year of purchase the 5000 spent for the appliances. Purchasing real estate is another way to set up a tax shelter because you can claim several deductions that renters cannot. Your income and filing status make your capital gains tax rate on real estate 15.

Can be tax shelters as well as certain insurance products partnerships municipal bonds and real estate investments. According to Im Anthony Martin the CEO and founder of Choice Mutual since investing in real estate helps you save money on your taxes through various deductions its a form of tax shelter. It is true if you plan to use deductions as a tax shelter.

A traditional individual retirement account IRA is another example of a tax shelter and works in nearly the same way as a 401k account. The higher your tax rate the more taxes you would save in this example. Key Takeaways A tax shelter is a place to legally store assets so that current or future tax.

An Analysis and Evaluation of the Real Estate Provisions of the Tax Reform Act of. Scenario 2 with depreciation expense. Resolving Problems Raised by the 1969 Act 29 NYU.

Tion on Real Estate and its Recapture. An illegal tax shelter on the other hand is a tax minimization strategy meant to minimize taxes. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate.

Historically real estate has proved to be a significant tax shelter. The IRS allows you to deduct qualified expenses related to owning a home including real estate taxes home mortgage interest and mortgage insurance premiums. The numbers listed below are annual.

5000 rental income 3000 depreciation expense 2000 taxable rental income. Using Deductions as a Tax Shelter. That is what real estate tax shelters are for.

Examples include fixing leaks painting and replacing broken parts of the rental property. 2000 x 25 federal income tax rate 500 taxes owed. These options however can only become available once your itemized deductions surpass the IRS standard deduction.

Common examples of tax shelter are employer-sponsored 401k retirement plans and municipal bonds. Sometimes in order to save money you must spend money. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other.

Investing in real estate is a logical route towards building wealth for investors. The Tax Court has consistently disallowed losses deductions and credits from transactions it deems to be tax shelters. Two of the biggest tax deductions are mortgage interest and depreciation.

Jim Harbaugh head coach of the University of Michigan football team is a prime example of someone who leveraged workplace benefits as a tax shelter Murray says. Tax Savings 1250 500 750. The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the wake of the proposed Section 163j regulations.

Its tax benefits are what have made it so attractive. Suppose you earn 500day and decide to set aside 10 of your income in the 410k plan. Purchasing real estate can give homeowners several tax-shelter options not provided to their renting counterparts.

At 22 your capital gains tax on this real estate sale would be 3300. So the investor has 5000 spendable cash in. Therefore you would owe 2250.

To see how a real estate tax shelter works lets go through an example using a 250000 property that generates 2000mo in revenue. These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b. The benefit of this plan is that you are required to pay tax on 450day 500-50 and not on the entire sum of 500.

As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year. What Are Examples Of Tax Shelters.

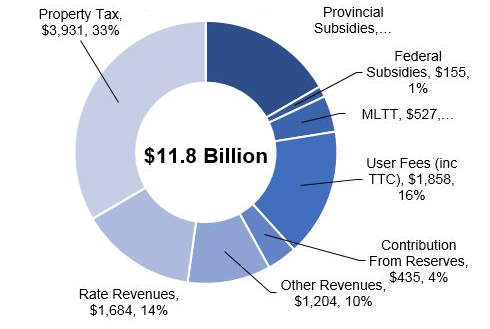

City Revenue Fact Sheet City Of Toronto

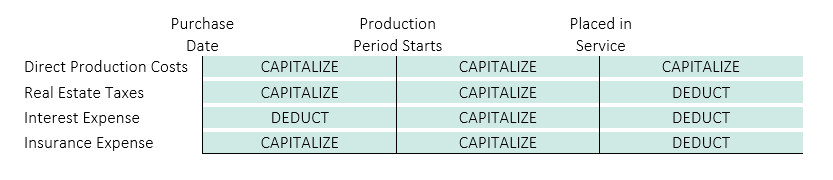

Real Estate Development When To Expense Vs Capitalize Costs Withum

Tax Shelter Difference Between Tax Shelter And Tax Evasion

Tax Shelters Definition Types Examples Of Tax Shelter

Tax Deductions On Rental Property Income In Canada Young Thrifty

9 Legal Tax Shelters To Protect Your Money

What Is The Biggest Tax Shelter For Most Taxpayers

Credit Shelter Trusts And Portability Eagle Claw Capital Management

How You Can Make Money From Your Rental And Show A Loss On Your Tax Return Semi Retired Md

Cra T1135 Forms Toronto Tax Lawyer

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Real Assets Examples Of Investments And Classification Types

What Is The Biggest Tax Shelter For Most Taxpayers

What Is A Tax Shelter And How Does It Work

How Is A Tax Shelter Calculated In Real Estate

Tax Shelters For High W 2 Income Every Doctor Must Read This